iowa inheritance tax changes 2021

Kim Reynolds signed into law Senate File 619 making various changes to the states tax codeSome of these changes are significant including reductions in the personal income tax a phase out of the states inheritance tax and an exemption for cancellation of indebtedness income under the federal Paycheck Protection. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

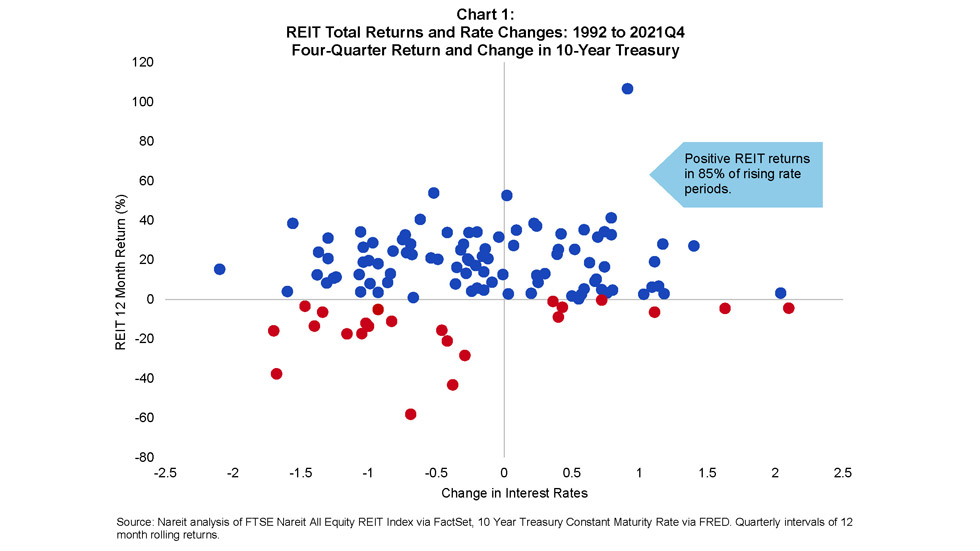

How Rising Interest Rates Have Affected Reit Performance Nareit

The 25000 maximum would become 300000 this year then would increase to 600000 and 1 million.

. The phase-down begins with deaths occurring on or after July 1 2021 with the first of nine annual tax rate reductions. Background Persons inheriting all or a portion of an estate from an Iowa decedent may owe Iowa inheritance tax on. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms. This 2021 tax legislation repealed the triggers so now these tax changes now take effect on January 1 2023 regardless of whether state general fund revenue targets are met. For information on inheritance tax please see our blog post titled Changes Coming to Inheritance Tax in Iowa.

On May 19th 2021 the Iowa Legislature similarly passed SF. IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. Inheritance Tax Rates Schedule.

619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st 2025. Iowa law allows the state to enact certain tax changes if the states net general fund revenue hits 83146 billion for the fiscal year ending June 30 2022 and equals at least 104 of net. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

14 The inheritance tax is phased out in the following manner. On June 16 2021 Iowa Gov. House File 841 passed out of subcommittee Monday afternoon.

Iowa has decided to end their inheritance tax starting in 2021 and will completely abolish the tax by January 1st 2025. In addition to the changes described above the Governor signed Senate File 619 in 2021 which in part conforms Iowa to the additional first-year depreciation under IRC section 168k bonus depreciation for property placed in service during tax years beginning on or after January 1 2021. Individuals would be able to inherit 1 million worth of.

The 2018 Iowa tax reform laws contained tax revenue triggers that the state was required to meet to initiate certain tax changes beginning in 2023. The proposal phases out Iowas inheritance tax by 20 a year over four years resulting in a fully eliminated tax in 2025. 619 Iowa will phase out its inheritance tax on property passing from the estate of a decedent dying in 2021 through 2024 with full repeal of the inheritance tax becoming effective for decedents dying on or after Jan.

The inheritance tax and the qualified use inheritance tax are repealed effective July 1 2030. Adopted and Filed Rules. Several provisions including the.

Inheritance tax phase-out Under SF. The bill would gradually raise the size of an estate exempted from the tax. This article will further discuss and explain the Iowa inheritance tax how it is calculated and also changes to the Iowa inheritance tax which will be gradually reduced starting in 2021 and phased out entirely by 2025.

President Biden has proposed treating the transfer of inherited property as if it were a sale so capital gains taxes would be collected. If the bill becomes law three changes could take effect on Jan. The nonpartisan Legislative Services Agency estimated that the changes will represent a 2976 million reduction in state income tax liability in 2023 and then more modest reductions in future years.

State inheritance tax SF 619 proportionally reduce s over a four -year period the rates of tax applicable to the. After several late-night homestretch sessions the Iowa Legislature passed a sweeping tax bill SF 619 which is expected to be signed into law by Governor Reynolds shortly. On June 16 2021 Governor Reynolds signed this bill into law.

Net operating losses NOLs SF 619 repeals the contingent tax changes in 2018 Iowa Acts Chapter 1161 Sections 99-132. Inheritance Tax Rates Schedule. A panel of Iowa House lawmakers moved a bill Monday that would eliminate Iowas inheritance tax by 2024.

Death Tax Repeal Act of 2021 Congressgov. Read more about Inheritance Tax Rates Schedule. With passage of the new bill if one were to pass away in 2021 the inheritance tax imposed on the inheritor would be reduced by 20 from the original.

Complete Edit or Print Tax Forms Instantly. Iowa taxpayers who claim the additional first-year depreciation under IRC section 168k. Conversely a new tax proposal under the Biden administration seeks to reduce the exclusion limit from 117 million or up to 234 million for married couples to 35 million or.

As a result effective for tax years beginning on or after January 1 2023 Iowa. The bill would modify Iowas income tax and property tax law in key ways. Lower the top individual income tax rate from 853 to 65.

It would also eliminate Iowas inheritance tax over three years.

Survey Wisconsin Farmland Worth 10 Percent More Than In 2020 Wisconsin Public Radio

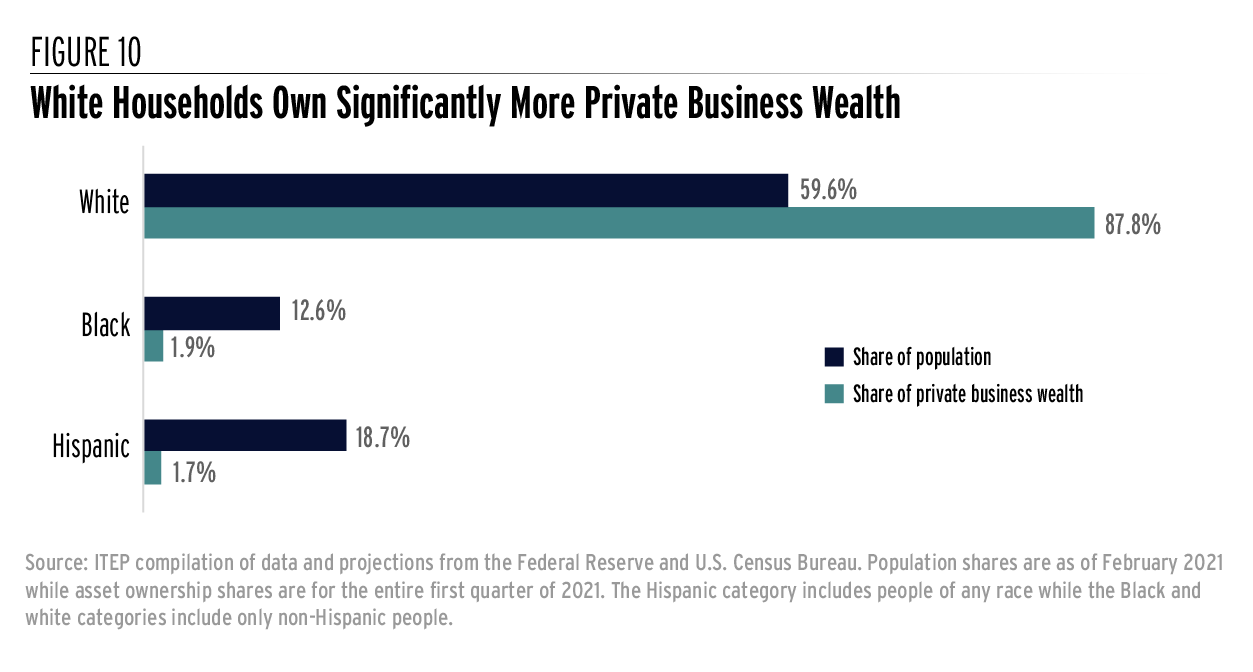

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Income Tax Increases In The President S American Families Plan Itep

The Best Places To Retire In 2021

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Iowa Paycheck Calculator Smartasset

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Axne Costa Lead Effort To Protect Family Farms From Inheritance Capital Gains Changes Representative Cynthia Axne

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Benefit Forms Resources University Human Resources The University Of Iowa

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

The Best Places To Retire In 2021

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Minnesota Tax Rates Rankings Minnesota State Taxes Tax Foundation

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service